TEB has tailored its privileged and high-quality services delivered through a total of 12 corporate branches, 5 of which are in İstanbul, in line with its long-term customer relations approach. The Bank provides its services through its sales, cash management, foreign trade centers staffed with experienced specialists and an organization specifically designed for multinational companies. In its Corporate Banking business line, TEB is backed also by the synergy created with the global network of its shareholder, BNP Paribas.

Under the “New Service Model” that was introduced in 2021, TEB restructured its İstanbul corporate

branches, organizing them according to customer segments. Three branches were opened during the

year.

In line with its goal of being “the first bank that comes to mind of customers” in the Corporate Banking

business line, TEB will resolutely carry on with its new product and service solution developments.

Since 2006, the Bank has been offering service to resident subsidiaries of multinational companies. In

these services, TEB benefits from its own extensive network of domestic branches in Turkey as well

as the cooperation it has developed with BNP Paribas, which operates with approximately 190,000

employees in 65 countries with the slogan “One Bank for Corporates”, and has more than 30 million

customers and more than 7,000 branches.

The Multinationals Desk services İstanbul-based companies backed with foreign capital out of its

Multinational Companies Corporate Branch. Foreign companies based outside of İstanbul, on the other

hand, are furnished service by dedicated specialized teams at corporate branches and at the Head

Office. TEB seeks to be the main bank with which all multinationals with operations in Turkey prefer to

work as almost 1,300 multinationals from 45 countries already do. In all its activities, TEB matches the

highest level of service quality and standard that global partners of foreign-capital companies receive

from BNP Paribas at the maximum extent permissible under the applicable legislation in Turkey.

TEB is a differentiated and specialized bank in foreign

trade. This competence is complemented and further

reinforced by the global service network of BNP Paribas,

which ranks among the world’s top three and Europe’s

leader in foreign trade finance.

At over 100 locations, Trade Centers of BNP Paribas

add to TEB’s competitive strength in this arena. Backed

by the global service capability at its disposal, TEB

makes available digitally to its customers Export Value

Acceptance Document (in Turkish: İBKB) issuance

solutions, as well as letter of credit documentation

preparation, which is a specific operational process.

TEB maintains correspondent relationships with more

than 1,000 banks located all over the world. Expanding its

correspondent network in line with customer needs, the

Bank also makes use of the strong correspondent network

of BNP Paribas.

Through its correspondent network, TEB facilitates

money transfer services for its customers that require

transferring money in local currencies of different

countries owing to their investments in such countries.

Facilitating cross-border money transfer in 135 different

currencies to more than 180 countries, TEB also offers

cash transfer services to customers who want to make

bulk payments at competitive costs through its wide

correspondent network.

Located in İstanbul, Bursa and İzmir, TEB Trade Center

network providing foreign trade finance and foreign trade

consultancy products and services is the first of its kind

in the Turkish banking industry.

Trade finance solutions suited to customers’ needs are

tailored via benefitting from TEB’s and BNP Paribas’ trade

finance expertise and extensive correspondent networks.

TEB possesses a competitive and strong position in export

finance which is verified by sectoral data.

Every TEB Trade Center employs a team whose members

have expertise in “structured trade and commodity

finance”. This team devises financing solutions that are

specifically tailored according to the goods involved

and customer cash flows. In this way, firms can be

offered tailored products that go beyond the sector’s

conventional financing methods.

TEB initiated lending against electronic product

certificate (ELUS) via the infrastructure it has brought to

completion in 2017, breaking new ground in Turkey.

Another solution TEB offers to exporters is rediscount

loan opportunities the Central Bank of the Republic of

Türkiye (CBRT) allocates to Turkish exporters.

TEB provides its customers with specialized consultancy

services related to their foreign trade and investment

activities.

In addition, TEB also works with sectoral and regional

exporters’ associations, chambers of commerce and

industry, organized industrial zone directorates and

similar organizations to provide practical foreign trade

training and seminars on foreign trade issues that are

designed to meet the particular needs of firms in different

parts of the country.

At TEB, large corporates relationship management is conducted by a team of Global Relationship

Managers at the Headquarters within the Corporate Banking service network. This structure is the

extension of the model implemented by BNP Paribas International Retail Banking organization in

various countries.

Relationship management with large companies includes large corporate companies which have been

established and grown in Turkey, and differentiated themselves in terms of revenue, geography and

diversity of financial transactions.

Global Relationship Managers possess the capabilities and experience to fulfill these companies’

strategic needs such as debt and equity capital markets, financial markets, project financing, M&A

advisory, as well as their conventional banking needs like operating loans, cash flow and foreign trade,

and to render/coordinate all these services.

Backed by a strong technology, TEB Cash Management kept responding to customer needs with digital

solutions in 2021. As cash management products gained the foreground recently, the Bank introduced

Internet banking and mobile banking applications, as well as such products as E-signature and

Mobile-Ink, the instruction management platform for banking service orders. In the collections area

that is of particular importance to corporate and commercial customers, the Bank launched its new

product, the TEB Mobile Collection Platform.

With this innovative product that allows businesses to process all collections made by their sales

teams without having to carry several devices such as POS devices, laptops and phones using various

collection instruments such as credit cards, cash, cheque or promissory notes, lets them instantly

track the collections at the head office, and enables regular reporting of collections, TEB claimed the

Bronze Stevie in the Cash Management category at the Stevie International Business Awards.

By early 2021, TEB Cash Management completed the necessary developments

and took place among the first banks to join the FAST (Instant and Continuous

Transfer of Funds) system launched by the CBRT.

TEB clients are able to define Easy Addresses quickly and securely on

CEPTETEB Mobile and CEPTETEB İŞTE applications, and can transfer money

rapidly, securely and instantly 24/7 via the FAST system.

Through CEPTETEB İŞTE Mobile Banking, its comprehensive and user-friendly

digital banking platform tailored for commercial customers, the Bank offers

the chance to view and quickly share messages about SWIFT payments, view

SWIFT GPI tracking system data and instantly follow-up the status of the

payment end-to-end.

2021 also saw the introduction of the SWIFT SCORE (The Standardised

Corporate Environment) payment service. TEB clients are able to forward

TL or FC money payment orders to the Bank in MT101 or FileAct formats from

their own SWIFT addresses using SWIFT SCORE, which is a closed-circuit

system for firms to exchange messages with financial institutions and send

their payment orders.

During 2021, TEB kept evolving and diversifying its supplier finance

models and enabled integration with fintech platforms. In our day when

open banking applications and partnerships with fintech companies gain

increasing significance, TEB Cash Management attaches great importance to

carry on with new developments that cater to customer preferences.

TEB Corporate Banking has adopted a customer-oriented approach in the product

and service processes it offers to its customers. Accordingly, the Bank further

developed and persevered with its strategy of “creating value for all stakeholders”

that promotes its target of flourishing the value proposal offered to its customers.

TEB continued to provide end-to-end solutions to corporates at all business lines,

including their whole ecosystem with a holistic approach offering TEB Group’s

range of financial and non-financial products and services in 2021 as well.

TEB Corporate Banking continued to further solidify the value offered to customers,

including those needing investment banking products, by taking advantage of the

strong international network and product line of BNP Paribas Group.

In this context, TEB provided the following high value-added services:

· support for commercial and investment activities

· local and international resources for the funding of foreign trade activities

· financial advisory

· M&A advisory

· project finance facilities

· intermediation of domestic and international borrowing instrument issuances or

public offerings.

TEB conducts synergy-based business development activities involving the Bank’s other business lines, in order to

create value for corporates in all areas of activity they are engaged in such as agricultural banking, consumer finance,

payment systems with card and POS services, solutions for dealers, corporate finance and salary agreements.

TEB’s domestic and international product and service variety stands out in its services provided through its affiliates

as well:

· TEB Arval offers its international experience to the fleet management sector as a solution partner for Corporate

Banking customers’ fleet management activities and provides fleet rental services to more than one million vehicles

worldwide,

· BNP Paribas Leasing Solutions provides financial solutions to Corporate Banking customers for their investments in

equipment and real estate,

· TEB Faktoring provides services in domestic and international factoring industry with an experience of more than 20

years and it has been awarded as the Best Export Factoring Company for the 7th time by the world’s largest factoring

chain Factors Chain International,

· TEB Investment carries out mediating activities for its customers’ public offerings, debt instruments, domestic and

international transactions and provides investment consultancy services,

· TEB Portfolio provides alternative fund management services for its Corporate Banking customers and many funds,

in which it is the founder and director,

· BNP Paribas Cardif Pension offers a range of advantageous fast and high-quality services to its customers in meeting

their group pension and insurance needs”.

Within the context of business development activities, TEB takes major steps to develop its Corporate Banking customer base. In line with these collaborations with major nongovernmental organizations, industry and trade exchanges have been realized.

TEB conducted joint business development activities with TEB Start-up Banking portfolio of start-up firms to provide support for corporate banking customers’ Industry 4.0 and digital transformation processes. A number of successful projects were carried on to improve service quality and efficiency with cooperation developed with BNP Paribas and business partnerships experienced in their fields.

The Bank closely monitored the “green” projects of public and private sector institutions and continued to provide solutions for their sustainable finance needs.

During 2021, which has seen the effects of the Covid-19 pandemic persevere, TEB also offered need-based business solutions adding value to customers to help corporate companies navigate through the rough market conditions with minimal impact. In cooperation with the Ministry of Treasury and Finance, the Bank provided various support and incentive packages to corporate customers which were targeted at reducing the financing costs of R&D and environmental investments.

Since 2017, via its Public Banking Department, TEB has been working to expand the scope of business with the public sector and to increase cooperation areas.

Within the context of these activities, it is intended to meet public sector’s needs in foreign trade, structured trade finance, cash management, and alternative funding facilities with BNP Paribas’ industry expertise and support for longer term and lower-cost funding.

The Public Banking Department carries on with its efforts to provide lowcost and long-term funding and other banking products to Public Economic Enterprises and Local Administrations.

In 2021, TEB Public Banking diversified its public institutions portfolio with new relationships established, and gave them access to alternative types of funding such as bond issuances in accordance with their medium-and longterm strategies, primarily through capital markets.

In this context, TEB gives priority to sustainable financing facilities. The Bank resolutely carries on with its efforts to implement and develop financing models that are environmentally-sensitive and support circular economy

Marketing and business management activities are carried out in parallel with the TEB Corporate Banking sales and marketing strategies that were formulated. These activities include oversight of action plans devised, conducting transformation projects backing strategy and goals and detailed analyses in improvement areas, and management and reporting of improvement projects for identified processes.

In 2021, “digitalization” was made the main focus upon reviewing the processes from the perspective of operational excellence and ensuring customer satisfaction by increasing the commercial time of employees. In addition, training programs were continued to be planned and executed in coordination with the Human Resources Department, which are designed to contribute to the development of the Bank’s employees, and to equip them with the knowledge and competencies that will help achieve the strategy and goals.

In addition to strategy and project management coordination, budget management and financial performance of Corporate Banking segment are monitored and reported, and in this context, support is provided for data supply in relation to sales, marketing and analysis activities of branches and related teams. Activities are carried out under the Corporate Banking organization to achieve full compliance particularly with the national and international legislation for prevention of laundering proceeds from crime and with the TEB and BNP Paribas Group procedures. To this end, implementations, examinations and training activities are managed in coordination with branches and related teams.

TEB Corporate Banking also carries out sustainability initiatives in line with its “positive impact” target, taking into consideration its environmental and social responsibilities. In this context, projects targeted at offering innovative and sustainability-focused products and services continue at an increasing pace.

TEB SME Banking keeps adding value to SMEs with its non-financial products and services, alongside effective financial support in keeping with its “consultant banking” approach.

TEB SME Banking focuses on offering customized service to its customers that vary in scale with diverse product and service requirements. Structured accordingly, TEB operates in the areas of SME, Agricultural, Start-up, Gold and Municipal Banking segments. The Bank provides information, training and partnership support to customers in terms of non-financial support.

Based on its vision of automation and digitalization of banking processes which is accelerated by the pandemic, TEB SME Banking targets to offer the best customer experience to SMEs. Hence, taking into consideration the impacts of the pandemic and altered customer expectations, the Bank redesigned its products and processes in order to provide faster and solution-oriented service to its SME customers and kept offering privileged means to its customers to prep them for the global competitive arena.

TEB assessed demands for deferment of loan repayments by customers with disrupted cash flows and having difficulties in repayment of credits with a sense of responsibility. The Bank formulated new repayment plans compatible with their cash flows, and fulfilled additional credit demands. During the reporting period, TEB sustained its support to the SMEs uninterruptedly in KGF (Credit Guarantee Fund) and KOSGEB (Small and Medium Enterprises Development Organization of Türkiye) supported projects.

Backed by the synergy of BNP Paribas’s global service capability, TEB also extended support to its exporter customers’ investments for increasing their employment and trade volumes.

Blending its strong international correspondent network and foreign trade expertise, the Bank provided financing facilities at favorable terms and advantageous costs. Need analyses were performed for exporters that have a strategic importance for the Turkish industry and customized product and service models were designed accordingly. Advisory needs of foreign trade customers continued to be fulfilled by expert teams.

TEB let its customers manage their day-to-day banking transactions at low-costs with its products offering cost advantages such as “KOBİ Dört Dörtlük” and “KOBİ PRATİK”. In this framework, SMEs were offered the chance to perform SWIFT and other transfers free-of-charge for a period of up to six months in their import and export transactions under three different Foreign Trade Expense Packages differentiated according to customers’ scales, and to benefit from advantageous exchange rates for buying and selling FC on the TEB FX Platform.

Based on its industry expertise, TEB SME Banking serviced its customers with specific products such as ELUS (Electronic Product Certificate) loans, Gold Flexible Installment Loan for the gold and jewelry industry, as well as loans with grace periods. The Bank continued to cater to its customers’ insurance needs with the broad product ranges of Zurich Sigorta and Cardif Sigorta.

TEB positions CEPTETEB İŞTE, its digital platform granted seven awards by some of the world’s most prestigious recognition programs including those of the IFC and The Banker, as one of its main service channels.

CEPTETEB İŞTE lets commercial customers reach TEB quickly and easily to perform their day-to-day banking transactions practically.

TEB kept further developing its CEPTETEB İŞTE mobile banking application in 2021. In this

context, the Bank added the following functions to its digital service channel.

· CEPTETEB İŞTE Digital Loan Utilization,

· FAST 24/7 money transfer,

· KOLAS – Easy Address integration and transfer,

· Revolving (Bank Overdraft Account) loan utilization and repayment,

· SWIFT payment monitoring and payment tracking (SWIFT GPI),

· E-mail verification and deletion,

· Payment with QR Code (using a credit card),

· Insurance policy monitoring.

Innovations were introduced also in corporate internet banking. In this framework, the Bank made available the capability to issue İBKB (Export Value Acceptance Document) documents to respond to the needs of foreign trade customers.

TİM-TEB Start-up Houses were first set up in 2013 with the aim of reaching start-ups all over the country, increasing the number of technology start-ups, and winning their innovative business ideas for the economy so as to assist them flourish healthily.

Maintained in partnership with the Turkish Exporters Assembly (TİM), TİMTEB Start-up Houses are currently active in seven cities, namely İstanbul, Ankara, İzmir, Bursa, Mersin, Denizli and Gaziantep.

Being the first bank to qualify as an implementation institution in TÜBİTAK’s Young Enterprise (BiGG) Program, TEB is in leadership position in the program of which it has been a part for six years.

So far, 92 start-up companies have been incorporated within the scope of the BiGG Program. Start-ups in TİM-TEB Start-up Houses were given access to grants worth TL 15.4 million in total.

While supporting new generation ventures, TEB provides supports that will contribute to digital transformation journeys of SMEs and corporates at the same time. In this framework, technology companies offering innovative solutions were brought together with over 60 corporates under the S2C (Startup/Scaleup2Corporate) programs launched as an initiative of TİM-TEB Start-up House.

With the aim of increasing its contribution to digitalization of SMEs that serve as the engine of the national economy, TEB organized the SME-Startup Gatherings event on the digital platform in 2021. In this event, the Bank brought its SME customers from different sectors together with start-ups that might have a potential impact on their ways of doing business.

TEB is also involved in the international cooperation processes of the start-up ecosystem. The Bank undertakes forward-looking planning with French Tech İstanbul, and helps TİM-TEB Start-up House start-ups reach the European market, primarily the French market, to find clients and investors.

2021 marked the launch of AWE (Academy for Women), a joint program by TİM-TEB Start-up House and the US Embassy for helping women entrepreneurs in Turkey strengthen and become globally successful entrepreneurs. 40 successful women entrepreneurs were supported through the Start Up and Scale Up programs implemented within the scope of the AWE Program.

Under various acceleration programs conducted since 2015, more than 150 women entrepreneurs received support from the TİM-TEB Start-up House. Employment created by women entrepreneurs reached 1,000 people as of year-end 2021.

TEB Public Banking remained one of the main banks of local administrations also in 2021.

With the Municipality Banking special business model, the Bank provided municipalities easy access to financing and contributed to more rapid infrastructural investments.

Providing the first online/real time collection service within the scope of its cash management solutions, TEB offered a faster and easier service for citizens to make their payments to municipalities.

TEB continues to add value to its customers with its expertise in gold and jewelry industry, its accessibility and its products that make a difference in that industry. TEB is placed among the banks with the highest market share in the financing of the industry.

Also in 2021, as it has been doing for 25 years, TEB Gold Banking kept supporting the exporter companies in the Turkish jewelry industry, contributing significantly to their competitiveness in the world markets.

With the Municipality Banking special business model, the Bank provided municipalities easy access to financing and contributed to more rapid infrastructural investments.

Also in 2021, as it has been doing for 25 years, TEB Gold Banking kept supporting the exporter companies in the Turkish jewelry industry, contributing significantly to their competitiveness in the world markets.

In view of the lingering pandemic effects of 2021, TEB Retail and Private Banking Group continued to give the forefront to its customers’ health, needs, expectations, and the quality of their banking experience. The Bank delivered its innovative products and services to its customers without letup.

During 2021, TEB continued to diversify and enrich the products, services and campaigns in order to be able to offer customer-oriented solutions. Furthermore, the Bank expanded the range of services, offers and communications through digital channels.

Digital banking applications were and constantly are being developed, which secured significant growth and broadening in the use of services offered digitally.

In 2021, TEB continued to support its customers with skip payment and restructuring options in credit cards and retail loans.

TEB Retail Banking carried on with its activities with its satisfaction-oriented service understanding in 2021. Committed monitoring of customer acquisition channels, processes and habits brought a successful year in which banking targets were captured.

In 2021, the Bank authored solutions that made a difference in the sector on the back of infrastructural and methodical developments with the aim of delivering a better customer experience.

On the marketing front, customer touchpoints, communications and all campaigns were carried out with an analytical approach. Changing customer needs were responded to in a more productive and comprehensive fashion.

In a market characterized by constantly evolving technology and customer needs, TEB resolutely carries on with its efforts in line with its goal of making a contribution to its customers.

TEB targets to make a difference in the sector and deliver positive experiences at all times. In its journey for achieving this target, TEB carries out its activities with the goal to “be the most recommended bank”; to this end, the Bank constantly measures customer experience.

In 2021, the Bank measured the quality of the customers’ experience with TEB, the degree of their satisfaction with products and services, and the level of their recommending the Bank using the NPS (Net Promoter Score) methodology

During the reporting period, the Bank listen the voices of approximately 210 thousand customers from five different contact channels, namely CEPTETEB, Call Center, branches and Turbo device. Survey results were regularly analyzed by the business units and necessary enhancements were made in improvement areas in customer experience.

As a result of technological upgrades carried out in 2021, the Bank continued to incorporate digital channel alternatives within customer experience measurement system. While these developments served to receive customer feedbacks easily and quickly, customer measurement system was converted into a multi-channel and digital structure.

Based on its competence to contact the customers through their most preferred channels and to be accessible thereon, TEB integrated digital channels with the customer experience measurement system.

Due to the changes that resulted in customer behaviors due to the pandemic conditions, digital transformation remained in focus by TEB during this process.

The highlights of TEB’s major developments and

improvements on its digital and branch channels in 2021 are

as follows:

· Customer acquisition from digital channels,

· Increased cash withdrawal limits from ATMs,

· Increased number of turbo video devices and upgrades on the devices,

· Efforts for prioritization of contacts at the call center,

· Communications for referring customers to use digital

channels,

· Capability to transfer pensions from another bank through

digital channels.

TEB also keeps investing in CRM, big data, analytics and real-time interaction technologies for gaining a better insight into customer needs and responding to expectations with correctly-timed personalized offers.

TEB aims to reach its customers through a higher number of channels, and give its customers effortless, fast and reliable access to all banking transactions digitally, as well as through physical channels.

During 2021, the Bank carried out effective, continuous and multi-channel communication activities in loan and deposit products and this contributed to new customer gains.

From the onset of the pandemic, TEB carried out a multi-dimensional and intensive activity in retail loans. The Bank emphatically manifested its support to customers by granting deferment on consumer loan balances to its customers suffering from disrupted cash flows.

Employment of digital channels to respond to customer demands allowed customers to defer their payments easily, and all customer demands deemed acceptable were fulfilled quickly

While a 3-month deferment option was offered for repayment of consumer loans, the Bank secured effective portfolio management aimed at the right target audience on the back of analytical studies conducted, as well as enhancements made to existing loan products and processes. Analytical CRM models helped increase campaign efficiencies remarkably.

“Marifetli Account”, which has changed Turkey’s savings habits, is a savings product with a daily term and provides account holders the flexibility of depositing or withdrawing cash at any time.

As savers turned to Marifetli Account at a higher extent amid the varying interest rate environment of 2021, the balance in TL Marifetli Accounts expanded by 6.2%. Marifetli Account offered advantageous interest rates to savers throughout the year with its attractive campaigns.

Global Youth (Genç) Account which is a sub product of Marifetli Account offers a lower limit of 100 TL/EUR/USD/GBP to encourage youngsters’ savings. By this account, youngsters earn income on savings of lower amounts and gain awareness on savings at an earlier age.

TEB mediates salary payments of numerous large corporate and public sector institutions with the target of being “the most preferred bank” in salary payments.

Supporting the expansion in the Retail Banking business line, salary account customers constituted 24% of newly acquired customers in 2021.

In 2021, special packages offered to customers with salary accounts are enriched with favorable loan terms, deposit rates and discount campaigns for a range of products. Custom-tailored retention programs are developed for those customers whose salary agreements ended enabled customers loyalty in long term.

The number of TEB’s pension account customers grew by 80% over the course of two years.

Throughout the year, the Bank offered promotional campaigns to customers transferring their pension accounts to TEB, thereby enriching its product campaigns targeted at customer needs with promotion offers.

System developments were introduced to let pension account customers transfer their SGK (Social Security Institution) pensions to TEB without going to a branch in the face of the pandemic conditions using CEPTETEB mobile application, which started to be used actively. In addition, “My Pension at TEB” menu, which allows pension account customers to view all customized offers and campaigns using the CEPTETEB Mobile App, was also put into service.

Advantageous credit rates and special customer programs were made available to existing and newly acquired pension account customers, under which they were provided with advantages in various aspects from credit cards to supermarket and healthcare expenses.

In 2021 TEB partnered up with management of apartments and building complexes and carried out activities for school payments and transferring parent accounts to TEB in line with the goal of acquiring new customers.

TEB renewed its Affluent Banking propositions to its customers in the mediumupper income group in the second quarter of 2020. Following the said study completed in 2020, developments and innovations continued in 2021.

Offering the renewed financial and non-financial privileges with a holistic banking approach, TEB strengthened customer loyalty. This development brought 31% increase in the number of TEB Affluent (Yıldız) Banking customers in 2021.

Since 2014, TEB has been working to make its branches and other service outlets capable of offering service under “Accessible Banking”- concept. With its initiatives, the Bank has been eliminating the barriers to accessing banking services, and letting its customers with disabilities to easily perform their banking transactions.

TEB offers service to its visually-impaired customers out of 280 branches, via all the TEB ATMs and 45,207 POS devices, and to its orthopedically-handicapped customers out of 310 branches and via 685 ATMs. The Bank offers prioritized service to its customers with disabilities through its other channels as well.

TEB works in a synergetic collaboration with BNP Paribas Cardif and Zurich Sigorta in the area of bancassurance.

Offering life and non-life insurance and private pension products to its customers, TEB boasts a wide product range covering life, personal accident, agricultural, gold, engineering, unemployment, health, liability and pension plans. During 2021, TEB Bancassurance continued to offer service both through the Bank’s branches and alternative distribution channels in order to respond to its customers’ needs for insurance and private pension products.

TEB Bancassurance is also focused on developing and improving its business processes. The Bank established an information structure which enables viewing and printing the policies purchased via internet and mobile banking, and to search past policies. The digital approval function that was launched allowed customers to approve the proposals themselves, thereby responding duly to the pandemic circumstances.

TEB also started selling the “Complementary Health Insurance” and the “Complementary Health Insurance Plus” products, which are targeted at eliminating customers’ health concerns in the face of the pandemic conditions, and also put into service the developments enabling sales of these products on CEPTETEB Mobile App.

An extension of TEB’s responsible banking understanding, TEB Family Academy set on the road with the motto “Economy Starts in the Family” in 2012 and has carried out numerous projects since then.

Expanding the habit of saving up across the society, securing sustainable economic growth, and helping raise a financially literate generation made the focal points of the systematic initiatives and training programs realized.

Targeted at many different segments such as the youth, women, employees, entrepreneurs and retirees, Financial Literacy Trainings are open to everyone and offered free-ofcharge.

Participants in the Academy’s training programs receive basic financial literacy information under the headings of saving up, budget management, correct use of loans and cards, investing and investment planning, risk perception, information on financial rights and obligations, raising increased awareness of financial literacy, and balancing expenses and income.

To reach a highly financially-aware composition in society, to determine and periodically measure the level of countrywide financial literacy, a Financial Literacy and Access Index is being calculated since 2013 under the cooperation of TEB and Boğaziçi University Center for Analytics and Insights.

In 2020, the financial impacts of the pandemic and the changes it has caused were included in the research. It has been observed that the pandemic drove digitalization of individuals and differentiated their saving methods and reasons.

From 2020, face-to-face training programs were suspended and digital trainings were initiated because of the pandemic impact. It is observed that financial literacy efforts increase financial access score. On the other hand, it is also noted that the fact that access to banking products in Turkey is being improved with simpler and user-friendly apps contributes to digital access.

Preparing for the post-pandemic period, TEB carried on in 2021 with its training programs on financial literacy, financial access and promoting the habit of saving up. During the reporting period, the Bank brought financial literacy training to over ten thousand individuals from eight different sectors in approximately one hundred and fifty sessions.

Among the groups participating in the training were some of Turkey’s deep-rooted companies, transportation companies, educational institutions, and one of Turkey’s biggest e-commerce companies.

TEB has been offering private banking and wealth management services since 1989. TEB Private Banking operates out of 13 Private Banking Centers and 4 inbranch corners located in Turkey and the Turkish Republic of Northern Cyprus.

Combining BNP Paribas’ global know-how and experiences with an innovative service concept, TEB Private Banking services its customers with a rich product portfolio.

CEPTETEB Mobile application is designed with content and visuals differentiated according to the demands and expectations of Private Banking customers. Using the Mobile Approval function, which is a first in the sector, Private Banking customers can approve their transaction orders via CEPTETEB without a wet signature.

Mobile Approval has been an important factor that enhanced customer satisfaction and enabled uninterrupted continuation of service delivery particularly during the pandemic days.

In 2021, TEB continued to evolve CEPTETEB in line with the demands of Private banking customers. The Financial Analysis Report menu that lets customers analyze their past and current portfolios at the Bank was enriched. “Return Analysis” report is launched on CEPTETEB Internet Banking and Mobile App.

The “Return Analysis” report enabled TEB Private Banking customers to view the total value and distribution of their portfolios, and to review the monthly and yearly return performance of their investments.

TEB Private customers can review their assets they invest with TEB retrospectively on a daily basis with the “Daily Asset Analysis”, and access the daily Investment Strategy Report and Stock Report via CEPTETEB Mobile App.

TEB Private Banking rendered uninterrupted service to its customers amid the pandemic conditions in 2021. Customers reached TEB Private Banking Customer Representatives and performed their transactions by calling from their registered phone numbers.

They were kept informed about the markets and developments through regular teleconferences within the scope of Investment Consultancy services offered by TEB Investment.

TEB Private Banking offers customers investment consultancy service via its experts at specialty branches within the scope of Investment Consultancy model created by TEB Investment. TEB Investment consultants offer portfolio management model alternatives structured in line with investor profiles and according to different risk levels.

In light of the developments in international markets, TEB Private Banking increased its synergy with TEB Investment and TEB Asset Management and expanded its product range with new funds, alternative products and services in 2021.

Developments to watch in the economy markets and investment experts’ fund basket suggestions started to be shared on a weekly basis with Private Banking customers on CEPTETEB under the heading “Investment Agenda of the Week”.

During 2021, TEB Private Banking carried on with its activities addressing its clients on a remote-access format with “TEB Private Online Customer Events”. In the remote-access events that dwelled on a wide variety of topics from arts to history, from the European Green Deal to collecting, speakers specialized in their respective fields got together with TEB Private customers.

In 2021,

TEB continued to evolve CEPTETEB in line with the demands of Private banking

customers. The Financial Analysis Report menu that lets customers analyze their past and

current portfolios at the Bank was enriched. “Return Analysis” report is launched on CEPTETEB

Internet Banking and Mobile App.

In 2021, TEB enriched the digital banking experience delivered to its digital banking platform CEPTETEB with the addition of life-easing innovative solutions for customers.

Customer-oriented developments continued in April with the revamped home page of the corporate website. From 1 May 2021, CEPTETEB totally digitalized the customer acquisition process.

Potential CEPTETEB customers having an NFC- (Near Field Communication) enabled smart phone and Turkish Republic ID card could rapidly become a TEB customer by holding a video chat with the mobile app anywhere they wished.

Eliminating distances, paper consumption and many other operational burdens, TEB donated saplings for the first 20,000 people that have become the Bank’s customers with the 100% digital process.

Offering fast and easy-to-reach credit solutions to its customers on its digital channels, TEB updated pre-approved credit solutions so as to upgrade customer experience, merged them on the main page which is the page most frequently used and blended its customer- and solution-oriented perspective with its product and service diversity.

This experience was further enriched with the inception of the Complementary Health Insurance policy sales so as to cater to the pandemic-evolved customer needs and tendencies.

Use of digital channels in applications for consumer loans went up to 70% of total sales, while the share of deposit accounts opened via digital channels rose to 69%.

TEB offers its customers “Fast Track” at IGA, TAV and SAW airports, free-of-charge cash withdrawal abroad and departure fee payments through CEPTETEB Mobile App.

In 2021, TEB continued with its investments in technology.

One more step was taken in the advantage-packed world of CEPTETEB, and work was commenced on API technology, and on superapp with turna.com and Gen-pa, business partners that are leaders in their respective sectors. In addition, the new marketplace platform CEPTETEB Super was launched.

CEPTETEB Super facilitates airline ticket and electronic product purchases, and offers users an effortless shopping experience by filling in the necessary data at the time of purchase and payment securely and quickly with the API technology, alongside special discounts.

TEB continues to upgrade the banking service rendered to its customers with its mobile banking app and to increase transaction diversity through fast and successful integration of innovative developments.

Necessary digitalization efforts were carried out to let customers execute a higher number of transactions with less or no contact. Within the scope of the 3 Banks One ATM partnership, cash withdrawal and depositing with QR code were enabled from the ATMs of in-network banks.

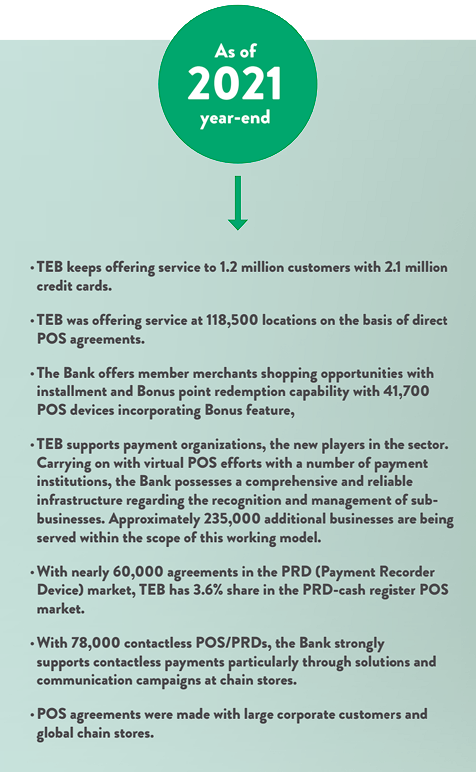

TEB continued its efforts in 2021 to facilitate payments of individual and corporate customers and develop new payment alternatives. TEB carries out activities to help customers perform their shopping transactions more easily, quickly and securely.

While security of card payments was further increased, additional product features were also enriched. TEB made available payment alternatives that will help merchants grow their turnovers.

CEPTETEB Digital Card makes the highlight of 2021 developments.

In this period of pandemic-shaped consumer habits, users who instantly became TEB customers by applying through CEPTETEB could apply for CEPTETEB Digital Card without a branch visit or signature process entailing a messenger service, upon which they forthwith accessed their cards and started using them for their purchases immediately.

In 2021, “Infinite”, the special card of VISA offering privileges to upscale customers, started to be issued to customers under the name “TEB Private Infinite Card” in partnership with TEB in Turkey with its metal card version. The card offers Private Banking customers not just a credit card, but also numerous unique benefits.

As TEB’s private segment customers feel privileged in the world’s leading hotels, they are also entitled to 10% discount on their expenses at many hotels and restaurants around the world. Additional benefits that users received under the said program include, among others, Zubizu Black membership, lounge access at select airports, parking fee discounts at airports and 24/7 Assistance Services.

As part of efforts for enhancing customer experience, functions were enriched to let customers perform all card transactions that they may need through digital channels.

A wide variety of campaign options are offered to customers via CEPTETEB, along with the opportunity to participate in the campaigns from the same platform. Within the scope of digitalization, global digital payment and card storage infrastructure solution provided by MasterCard with Masterpass application was offered through CEPTETEB Mobile App for TEB Credit Card holders.

Customers captured the opportunity to make their payments quickly and securely without sharing their card data with the business place when they make their purchases using TEB Credit Card and Masterpass via the Internet or the app.

TEB develops POS solutions and packages specific for each segment.

Accepting all popular cards via single bank and account, TEB makes merchants’ lives easier and add value to their businesses. The Bank provides merchants with the chance to accept 5 different card brands under a single agreement.

In the context of responding to sector-specific needs, the Bank expanded its service spheres by offering solutions and packages, such as TEB Milyem POS for jewelers, Harman Card and Harman POS for the needs for farmers and Professionals Packages.

TEB has led the sector through campaigns, which include opportunities intended for end-users and device variety.

Increased focus was placed on sectors defined as specific segments within the scope of Microbusiness Banking strategies. Under the advantage package devised for pharmacists within the framework of the collaboration protocol signed in previous years with the Turkish Pharmacists’ Association, an extremely special service had been furnished to pharmacist customers, and pharmacist customers at all locations where branches existed were offered these services and advantages.

TEB offered the experience it has built with its pharmacist customers to similar segments, i.e., veterinarians and opticians. Agreements were made with the professional chambers of both professions and advantageous terms started to be offered.

In a bid to extend support to businesses that suffered from the wildfires of 2021 and the flood disasters that hit certain districts in the Western Black Sea and Van in 2021 following the 2020 earthquake disaster in İzmir, TEB Microbusiness Banking joined the programs under which the principal amount was covered from bank’s funds, and the interest support by KOSGEB (Small and Medium Enterprises Development Organization of Türkiye).

Firms who documented to have suffered from the earthquake, fire or flood disasters that took place had access to loans of up to TL 250,000 with a 36-month term, entailing a repayment schedule of quarterly equal installments following a 12-month grace period.

Throughout 2021, TEB sustained its support to small businesses and tradesmen, the hardest-hit customer segment by the pandemic.

Numerous new functions ranging from rolling credit disbursement to password deblocking with SMS were added to CEPTETEB İŞTE, the digital banking application developed in line with the notion “your business is with you anytime, anywhere” that prescribes simpler and easier usage of banking products and services by Microbusiness Banking customers.

Approximately 93,000 Microbusiness Banking customers securely used CEPTETEB İŞTE, the award-winning digital platform that lets them view their instant turnovers and transactions for the last 7 days for POS, the key enticing product, gives them access to installment and rolling loans, let them pay installments, and control and monitor all their cash flows.

During 2021, Microbusiness Field Customer Relations (Remote RM) team comprised of experienced customer representatives that customers can instantly reach on the phone besides their assigned branch customer representatives started offering service to 200 branches.

Customers were granted the privilege to contact the same customer representative specifically assigned to their respective branch, receive answers quickly to their questions and have their transactions performed upon calling their branch or the Remote RM team.

TEB is focused on satisfying women business owners’ needs in business life and to be the women’s consultant bank. Increasing women’s participation in the business world and strengthening their presence in every area is crucial in terms of the added value contributed to the economy.

Women-owned businesses are faced with problems in their incorporation and growth phases, particularly in terms of creating collateral and obtaining loans. For the solution of these problems, women need to be involved in the economy with their identity as producers at a higher extent.

In its efforts designed in line with this goal, TEB concentrates on extending the support women business owners need in financial and non-financial matters for sustainable economic growth.

In 2021, TEB’s cash lending to women-owned businesses increased by nearly 18%. In the reporting period, the Bank organized widespread events in Anatolia to reach women entrepreneurs.

TEB Women Banking aimed to reach women business owners and entrepreneurs all over the country by organizing widespread events particularly in Anatolia. Its content completely formulated to respond to the needs of women in business, TEB Academy for Women fulfilled women business owners’ need for knowledge to build their businesses, and brought them together with the women evoking inspiration with their achievements in the business world.

As an alternative to physical events, online gatherings were organized during the pandemic days.

Through WEConnect International, of which the Bank is a member and which targets to increase the share women get from the supply chain of corporate companies, women entrepreneur gatherings with large corporates are being organized. In these events, the diversity in procurement and eligibility criteria for being a supplier are addressed from the perspective of corporate companies, and women entrepreneurs find the chance to contact and get acquainted with the purchasing managers of corporate companies one-on-one. Events were organized in this context in Central Anatolia, Eastern and Southeastern Anatolia and Mediterranean regions.

As part of its digital transformation process, TEB embraced a working system integrated with technology targeted at economical use of resources.

Branch service models and customer journeys were redesigned according to regional needs and characteristics, and revisions were made to ways of doing business, roles and responsibilities.

Branch processes were digitalized and the number of documents were decreased thanks to fast advancing technology, which brought saving from time and paper consumption. This transformation helped create branches that are able to extend more support to customer needs and allocate more time for sales.

Within the scope of the new service model, transaction officers were positioned under the Mass Banking roof. Upon revised roles and physical rearrangements, TEB transaction officers were able to build closer and warmer dialogue with customers, offer service faster and increase their sales thanks to the tablets allocated to them.

TEB also produces solutions for its customers preferring to be serviced by branches, as well as non-branch channels. A product of the R&D efforts of TEB’s IT Department, the Turbo® devices can handle nearly 85% of the transactions executed at the counters.

Located in TEB branches, Turbo® devices allow performance of not only transactions involving a physical exchange such as cash withdrawal/deposit, payments, credit card delivery, etc. but also those requiring a wet signature, such as taking out a loan. As of 2021 year-end, Turbo® devices are being used actively at 166 TEB branches.

Customers who use the Turbo® device for performing their transactions choose to use it also on their next visit to the branch, and to handle their transactions themselves rather than seeking online support with increased use. On the other hand, TEB branch employees working on the sales side can now digitally perform customer transactions faster and more practically using their tablets.

Adapting advancing technology to its operational processes, TEB constantly builds on its business models and service channels based on its “customer-oriented” banking approach.

TEB Asset and Liability Management and Treasury Group has managed interest rate, liquidity and structural exchange rate risks with the aim of maintaining a sustainable profit for the Bank. The Group has adopted a management style based on sound, prudent and long-term strategies with its competent and experienced staff and the know-how developed in cooperation with the BNP Paribas Group.

In 2021, the Asset-Liability Management and Treasury Group contributed to its subsidiaries to work efficiently in within the boundaries set by compliance.

Despite the economic and political risks in 2021, the Asset and Liability Management and Treasury Group significantly contributed to the Bank’s profitability through proactive hedging strategies in interest rate and foreign exchange risk management.

The Group continued to take actions to secure funding diversity and funding maturity extension with the aim of reaching solid and consistent liquidity targets. Thanks to these actions it was ensured that the liquidity ratios remained within the limits and that the bank’s balance sheet was minimally affected by the high interest rate volatility.

The Group monitors the local and international markets closely to foresee the potential volatility in the market and so as to mitigate the structural risks in interest rate, FX and liquidity positions in the Bank’s balance sheet.

The expertise that is required to be able effectively manage those risks is another strength of the Asset-Liability Management and Treasury Group.

The Group is in constant communication with all the business lines to ensure that the balance sheet is composed of assets and liabilities with the right cost structure and in line with the competition faced from the market.

The Asset-Liability Management and Treasury Group plays an important role in modeling interest and liquidity risks accurately, measuring the realizations and the decision-making processes of the Bank through reports prepared for matters under the Group’s responsibility.

In 2021, the Asset-Liability Management and Treasury Group aimed at creating a stronger and more consistent liquidity for the Bank by securing a broad base of deposits.

To this end, the Bank focused on Marifetli Account and a substantial growth has been recorded in that product.

In line with TEB’s targets in digital banking, the Asset-Liability Management and Treasury Group maintained its supportive stance for the pricing made through the CEPTETEB channel.

For diversifying funding sources, the Group also initiated working on a cash flow based funding product towards securing long term funding from international markets.

Asset-Liability Management and Treasury Group incorporated TL REF, which is anticipated to replace TL Libor, in its product range, and played an active part in TL REF-linked loans and TL REF-linked interest rate swaps (Overnight Index SwapOIS).

The Bank also closely followed up the revocation of USD Libor. In this context, the Bank completed the necessary internal preparations for transition of the products that will use the new market rate and customer information processes.

Information flow between specialist teams to adapt BNP Paribas’ knowhow in modeling analyses to the requirements of Turkey by the AssetLiability Management and Treasury Group continued efficiently in 2021.

Competitive pricing of export loans and corporate loans have been enabled by the low-cost funding provided by BNP Paribas.

Additionally, work was carried out to adapt the liquidity and risk management policies implemented by the BNP Paribas Group to the Bank, and experiences were shared for a more efficient liquidity and risk management.

Specific activities were performed for intraday liquidity management and experiences were shared to effectively manage liquidity under stressful situations.

Operating since 2011, TEB Corporate Investment Banking Group provides Turkish companies targeting strategic business opportunities at home or abroad with consultancy support that will cater to such pursuits. The business unit supports this service with loans and capital market transactions.

The Corporate Investment Banking Group targets to deliver customized international solutions with high added value to customers in a fast and effective manner. To this end, international gains are achieved with the support derived from BNP Paribas’ financial strength competency in global products.

The Group carries on with its customer-oriented activities in the fields of Global Markets, Financial Institutions, Large Corporate Groups, Large Corporate Groups Finance and Corporate Finance and Strategic Business Management.

In 2021, TEB Corporate Investment Banking Group successfully sustained its development despite the competition and toughening market conditions. In borrowing and international market transactions realized by the targeted clients, BNP Paribas’ wide range of products and geographical network has been efficiently utilized.

In a year when corporate firms and financial institutions were inclined to diversify their resources, the Corporate Investment Banking Group continued to offer international debt instruments to its customers and brought them together with international investors.

Global Markets continued its operations in changing and developing global markets in a strong and sustainable growth trend in 2021.

Using domestic and foreign markets effectively, TEB kept generating original and tailored solutions for managing currency, interest and commodity risks, as well as for demands for transactions for deriving returns in a wide range of instruments such as spot, swap, options and structured derivative products.

Focus was placed on new generation digital solutions that will carry customer experience to the highest level, and fast and efficient service was rendered to customers both through the TEB platforms and multiple bank platforms.

The Large Corporate Groups Department offers various structured products and funding alternatives to the pioneering companies in Turkey by making use of the BNP Paribas’ wide global network.

The Department manages all kinds of banking transactions of Turkey’s leading large corporate groups, and develops banking solutions that are compatible with TEB’s customers and those of BNP Paribas alike. The Department extends the necessary support for the creation of favorable financing conditions (bonds, public offering, project finance, acquisition finance and sector-specific financing solutions etc.).

Developing high-level relationship management with its customers, the Large Corporate Groups Department targets to provide the products and service with the highest added value available at TEB and BNP Paribas at the highest extent possible. The Department also aims to strengthen its customers’ cash flows by producing different financing solutions, while at the same time setting policies to be positioned as the cash flow bank of these groups and ensuring efficient management of these policies.

In 2021, TEB has also pioneered the financial markets in terms of sustainability, with the intermediary service it provided for a Sustainability Linked Loan of a corporate firm in Turkey.

The Corporate Finance Department provided consultancy services in big projects in 2021, helped private capital funds in Turkey with their business ideas thanks to the rich client portfolio of TEB and intermediated strategic investments.

The Corporate Investment Banking Group is a structure that combines TEB’s power in the local market with BNP Paribas’ financial strength, position in global finance markets, expertise and experience in capital markets, structured finance and consulting.

Capable of single-handedly responding to a corporation’s all requirements in these areas; the Corporate Investment Banking is integrated into TEB’s client portfolio and BNP Paribas’ product range. This allows the Group to benefit from both the growing network of TEB clients and the strong global product specialists at BNP Paribas.

The loan with a 367-day maturity, which is also TEB’s maiden sustainability-linked syndicated loan, reached a roll over ratio of 113%. Signed on 27 October 2021, the syndicated loan linked to sustainability criteria is for the amount of USD 380 million in total and comprises of two tranches in the amounts of EUR 230.5 million and USD 113 million.

The all-in cost of the facility that will be used towards the general financing of foreign trade is set as Euribor+1.75% for the Euro tranche and as Libor+2.15% for the USD tranche.

While offering money transfer service to its customers requiring transfers in the local currency of different countries due to having investments in these countries via its correspondents, TEB provides money transfer service at competitive special costs to its customers carrying out bulk transfers, thanks to its strong correspondent network.

TEB Securities Services and TL Cash Clearing is part of Corporate Investment Banking Division. The department offers solutions for capital markets related operations and new products to non-resident financial institutions, foreign custodians, institutional investors and issuers of capital market instruments, with a consultancy approach.

Having completed its 14th year in the industry in 2021, TEB has been providing local custody and settlement services in cooperation with BNP Paribas Securities Services, which is Europe’s largest custodian bank, as a continuation of services that were originally established by BNP Paribas in Turkey back in the 1990s.

The department also offers post-trade services for its customers’ needs pertaining to capital market instruments, which may arise subsequent to their investment and financing decisions. In addition, TEB Securities Services and TL Cash Clearing also provides TL correspondent account service to non-Group banks and financial institutions. In 2021, the Bank rose to second place among the banks offering interbank TL payment service.

TEB Securities Services and TL Cash Clearing provides the following services;

· Settlement and custody services for equities, debt instruments and

other capital market instruments,

· Account operator services for International Central Securities

Depositories’ omnibus accounts in Turkish market,

· Collateral and cash management services for derivatives,

· Securities borrowing/lending transactions,

· Outsourcing services for brokers,

· Escrow and collateral management services,

· Debt instrument, certificate and warrant issue-related operations

and payment services,

· Account operating services for issuers’ central registry agency

accounts,

· Individual custody, collective portfolio custody and funding services

for portfolio management companies,

· TL Cash Clearing services to non-resident foreign bank groups.

Sustaining its successful performance as in the previous years, TEB Securities Services and TL Cash Clearing won new clients and carried on managing the transactions of clients successfully in 2021.

Having the global perspective with a pioneering and client-focused approach TEB remains the choice of clients seeking more than a custodian bank for post-trade services in capital markets and TL Cash Clearing services.

The department consistently ranked first in the surveys conducted

by the market’s leading institutions in 2021, which polled customers’

opinions and scores:

· Global Custodian - Agent Banks in Emerging Markets (ABEM 2021)

· Global Finance Magazine - Country Award Best Sub-Custodian Bank 2021

TEB Securities Services and TL Cash Clearing monitors all the developments realized by regulatory bodies, namely Capital Markets Board of Türkiye (CMB), Takas İstanbul (İstanbul Clearing, Settlement and Custody Bank Inc.), Borsa İstanbul (BIST), Merkezi Kayıt İstanbul (MKK - Central Securities Depository of Türkiye) and the Banking Regulation and Supervision Agency (BRSA) from legal, technological and operational aspects. The department provides solutions to client needs on the securities services business with investments in new products and technology.

Making use of these developments as an opportunity to cooperate with clients and developing joint projects with them, the department stands out from the competition with its investments aimed at achieving operational excellence with priority given to helping its clients expand their businesses.

As a pioneering post-trade services provider, the objective of the department is to implement innovative solutions that will contribute to the development of the capital markets and the Bank.

To achieve this objective, collaborations continue with BIST, Takas İstanbul, MKK and Turkish Capital Markets Association (TSPB).

Significant developments occurred in the Turkish capital markets in 2021, and new product and cooperation development efforts continued throughout the year.

In 2019, long-awaited omnibus account structure for International Central Securities Depositories (ICSD) was launched. With this change, omnibus account structure which allows beneficiaries abroad to monitor and manage all their capital market instruments in a collective manner has been added to account types held under MKK.

Omnibus account structure is compatible with working principles of ICSDs. Using the account system adopted by these institutions all around the world for our country’s capital market instruments will help increase the use of Turkish capital market instruments in international transactions as collateral and facilitate integration of domestic markets with international markets.

Within the frame of the approval obtained, the department provides services for government domestic debt securities and lease certificates owned by foreign institutions and foreign funds, held in collective accounts to be opened with MKK.

The department expanded its customer portfolio by improving the correspondent banking service it provides to financial institutions.

Since the central counterparty (CCP) services started to be provided in the BIST Equity Market, TEB Securities Services conducted comprehensive evaluations with Takas İstanbul and the clients on the impacts of these changes on markets and services provided.

Work on becoming a General Clearing Member is planned to be completed in 2022. TEB continues its efforts to support development and growth of this market by becoming the leading bank providing this new service.

The department also works in close collaboration with other TEB affiliates active in capital markets.

In particular, the services related to BIST Futures and Options Market offered in partnership with TEB Investment has brought considerable success with increasing transaction volumes and number of customers.

TEB Securities Services Department continued to provide collective portfolio custody and fund services for portfolio management companies in 2021.